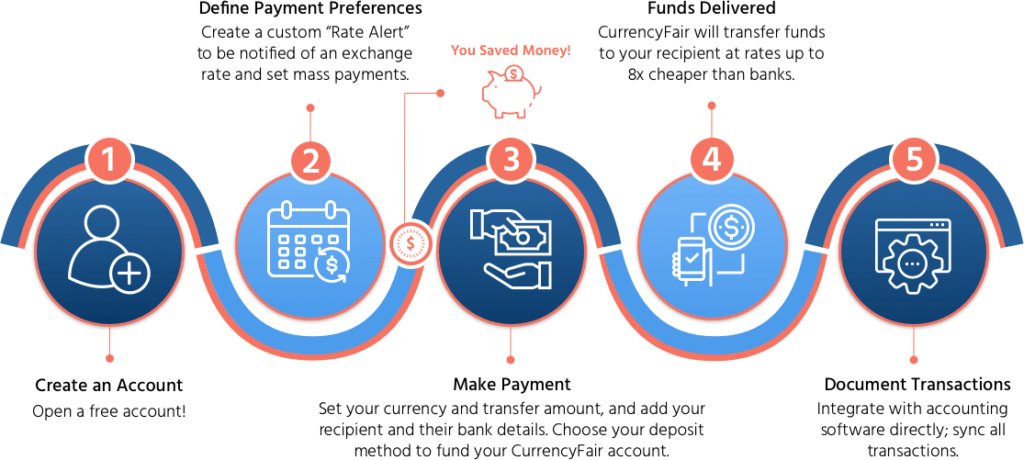

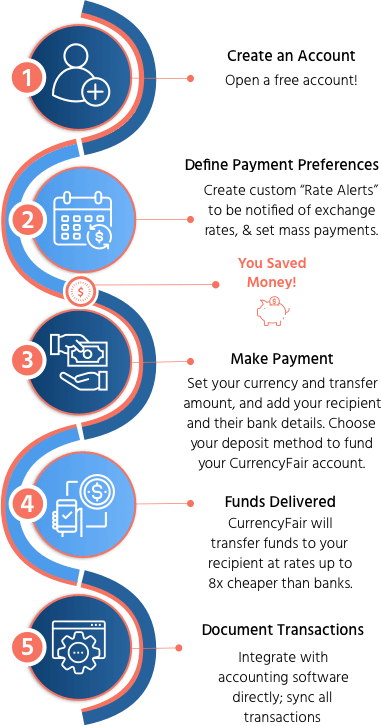

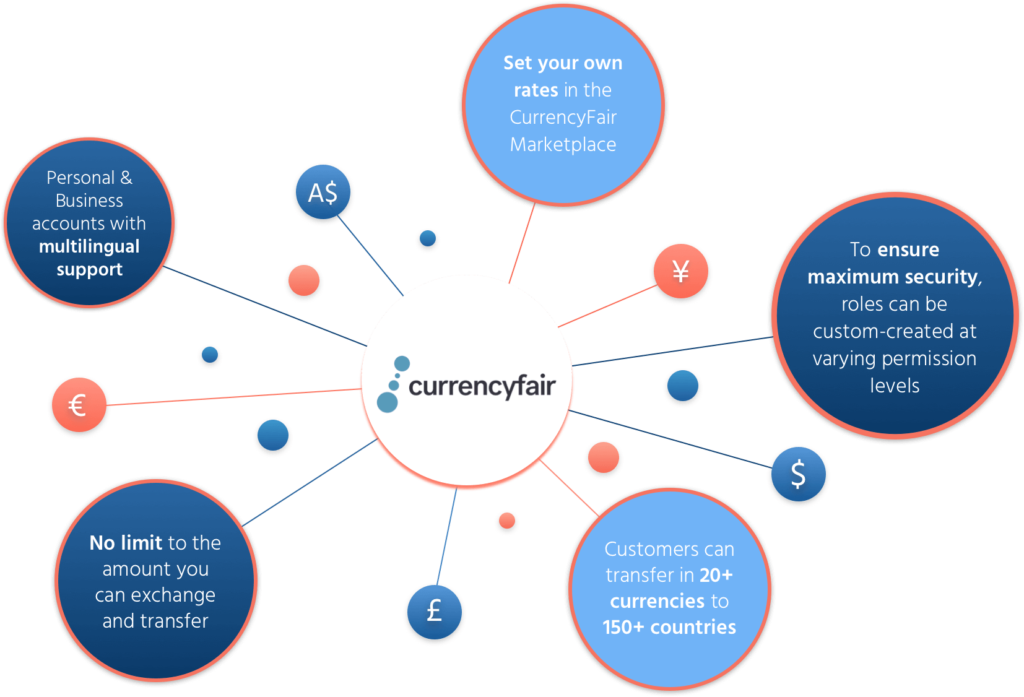

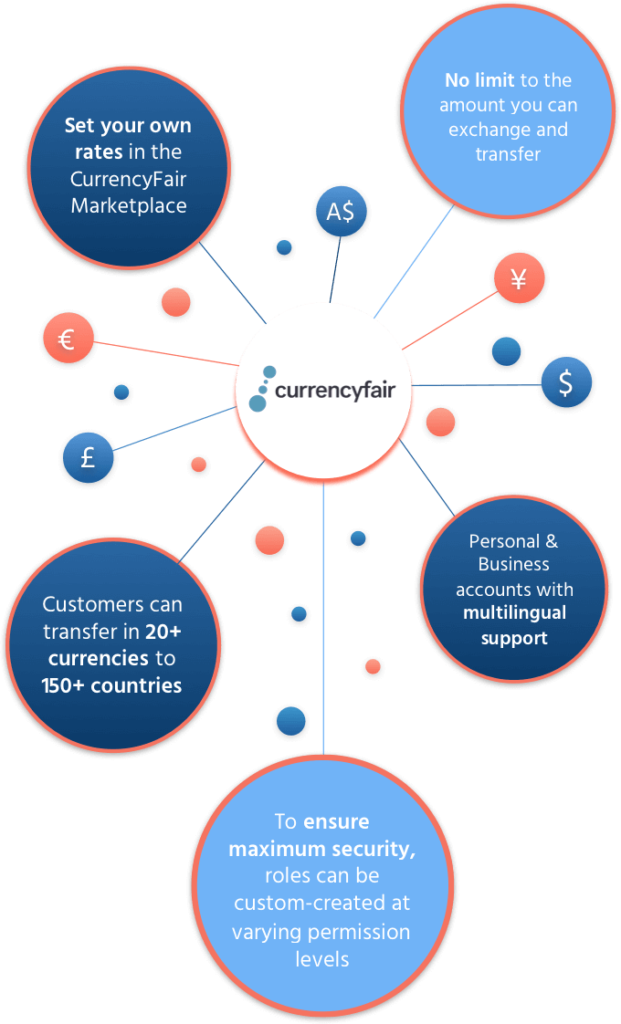

CurrencyFair founded in 2009, fully licensed, regulated, and award-winning peer-to-peer global money transfer platform with a simple way either send and receive money internationally.

CurrencyFair’s cutting-edge technology connects customers and businesses worldwide, allowing them to transfer money at a fair exchange rate, with no hidden fees to over 150 countries. Exchange funds in takes a little as 0-1 business days by bypassing banks and are up to 8x cheaper than banks.