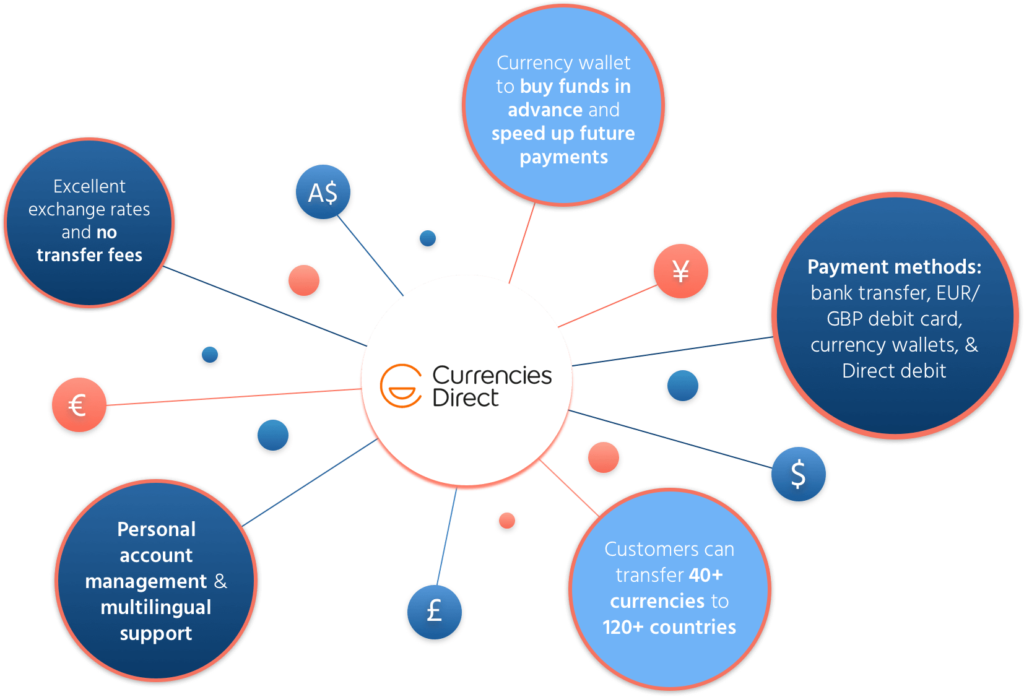

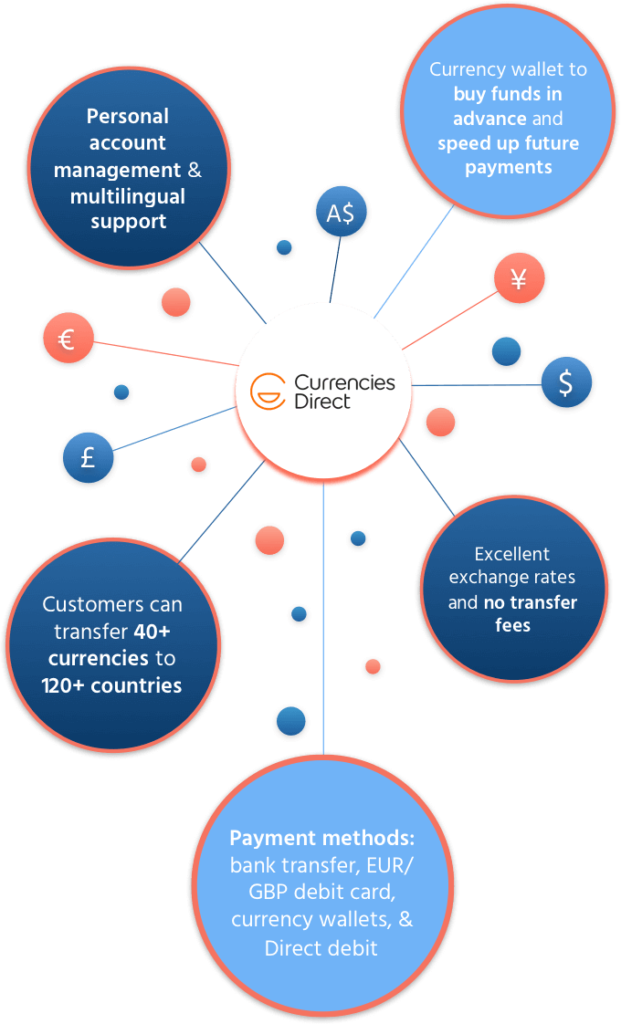

Currencies Direct has built up a reputation for itself as one of Europe’s most established currency providers since its launch in 1996. It has consistently shown positive growth in the marketplace through dedicated customer support, excellent exchange rates, and tailored transfer solutions. This firm has developed cutting-edge online services that enable customers to access reliable, flexible, and fast currency transfers worldwide. Its footprint has increased tremendously, and Currencies Direct now has a physical presence in the USA, United Kingdom, Portugal, Spain, India, Ireland, Canada, and South Africa. The business can service clients globally through these strategically situated offices.