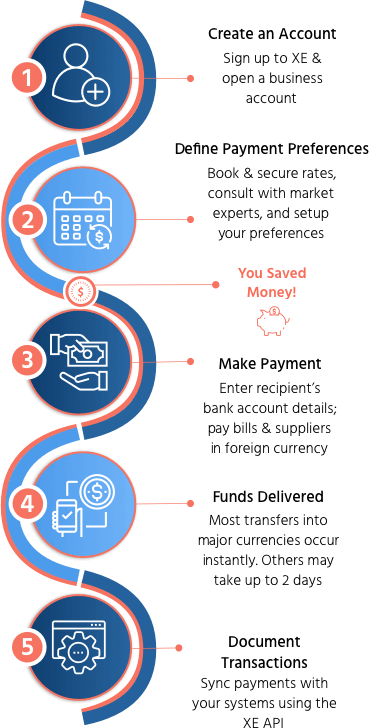

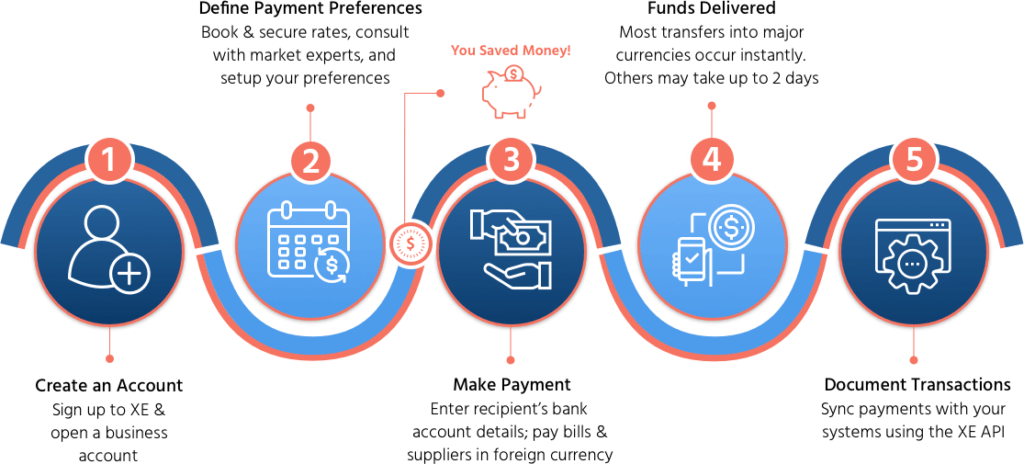

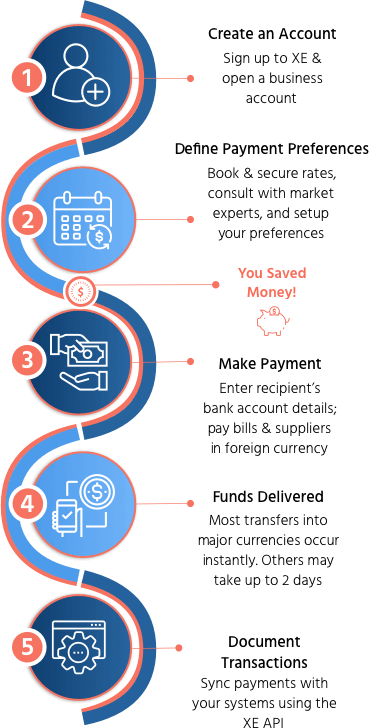

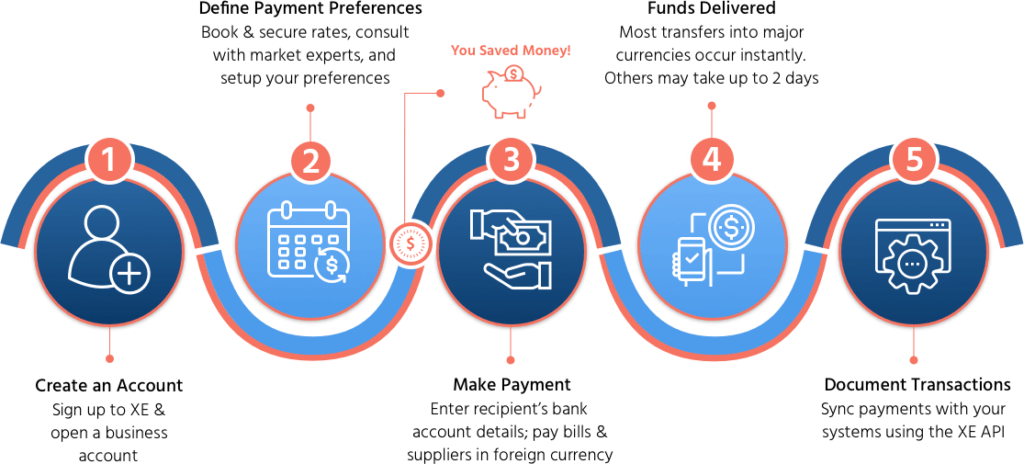

XE can help your business streamline payment processing. Create an account on the website to get started. Then define your payment preferences. If your business plans to make mass payments, you set them up inside the XE platform. You can secure a currency rate for your transfers for up to three years, based on the present exchange rate. To send a payment, you’ll need to enter the recipient’s bank information. You can also pay your suppliers in foreign currency if necessary. Transfers typically take one to two business days, though the time can vary significantly based on the receiving bank’s requirements. You can track your funds online through the XE platform or download the app on your smartphone.

If you choose to use the app, you’ll find the following features:

-

Money transfers to over 170 countries in more than 60 world currencies

-

Charts showing the history of any worldwide currency pairing

-

Monitoring capability for up to 10 currencies of your choice

-

Rate alerts and notifications

-

Currency list customization

Payment Process

Payment Process